Yes this chart is a bit sloppy but let me start by saying we went into Monday looking at Friday lows to highs. That 5740 at the Sunday open was a point of interest, defended and they ran it up to 5776 before the open. We opened around 5757 and saw an immediate sell and re-tested this 5740.

I had been stopped out of two trades already but wanted to use this 5740 as a dip into lows hopefully trapping sellers. My Stop was below 5732.5.

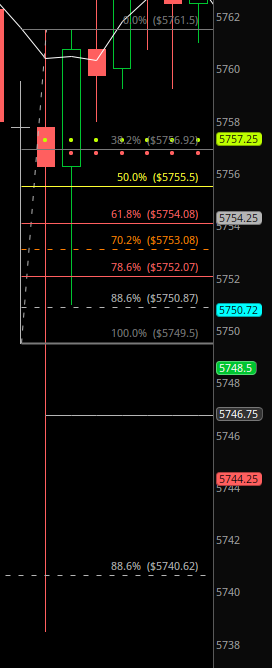

I used four contracts and entered around 5743, pulling off half at 5748, then 5753 and then 5758. So this trade made me $1750 but I was down $1200 from my first two trades, so I ended up on the day at +$550.

I was being super careful to not over trade as today is a Monday, and it’s a Monday before the US Election tomorrow.

My first trade I got stopped out thinking that we would find support at the Gap at 5756ish. however, it went right through 730 lows at the bell. I had 3 contracts around 5759 and was stopped out at 5755, losing about $600.

This 4 point stop happened again when I entered again towards the gap at 5753, being stopped out at 5749.

I have found that the 930am-10am timeframe is very challenging for me. Not always, but today was a good reminder to not be too aggressive and wait for the larger set up, which in this case the 5740s was correct for the time being to use as a short-term support.

Now I do want to point out that the ES is in a short set up, and it is valid until the 19.20s on the VX Futures are broken. This is what we are heading into tomorrow on 11/5.

Resistance at 5773-5780. If the VX breaks that 19.20 to the downside then we are looking at these resistance levels breaking to the upside. Tomorrow’s gap will be at 5744, so that will also be a point of interest for us tomorrow unless we are more than 20 points away from either side.